Description

Avoid Potential Risks and BIR Penalties

The Bureau of Internal Revenue (BIR) Regulations require Large Taxpayers to register a Computerized Accounting System(CAS). We invite Business Owners, CEOs, CFOs, CIOs, IT and accounting personnel who are experiencing challenges with accreditation due to the complexity of its requirements to this compact seminar on Computerized Accounting System compliance for Large Taxpayers.

This compact seminar aims to equip participants with information on BIR requirements for CAS and the knowledge on how to prepare for CAS accreditation and save on potential BIR penalties. There will be a presentation on actual challenges encountered in securing CAS accreditation and a discussion on how to prepare for the actual system demonstration required by BIR.

Let’s make your company achieve sustainable growth and proactively position your company to avoid potential risks and penalties. Be proactive, not reactive. Register today.

COMPACT SEMINAR PROGRAM

Registration

- BIR Regulations and Rulings Requiring Large Taxpayers to Register a CAS

- Computerized Accounting System

- The Taxpayer

- The Computerized System Evaluation Team

Coffee Break & Group Discussion

- Process and Requirements for BIR Accreditation

- Preparation for Demonstration

- Actual Scenarios and Cases of CAS Accreditation

- Post CAS Accreditation

Remaining time will be used for Q&A

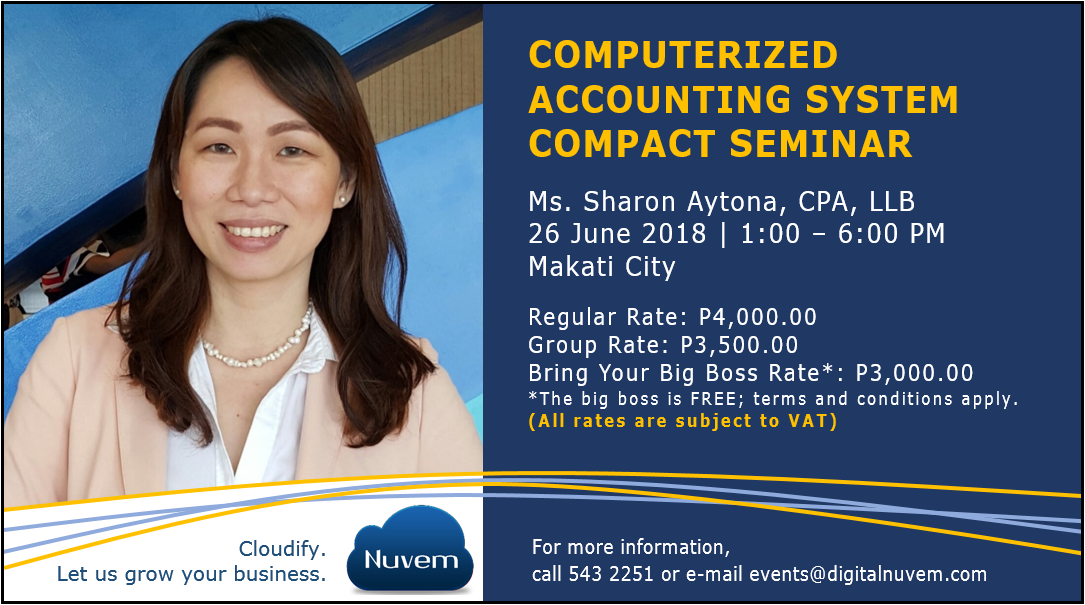

SPEAKER - Sharon Aytona, CPA, LLB

- Successfully helped several companies achieve CAS accreditation

- A seasoned professional with nearly 15 years of experience in accounting, tax planning, business development and management, an entrepreneur and a tax and accounting consultant

- An experienced lecturer at seminars and trainings on Computerized Accounting Systems

- Certified Public Accountant

- Cum Laude, University of the Philippines - Diliman, BS in Business Administration and Accountancy

- Bachelor of Laws, University of the Philippines - Diliman

SEMINAR INVESTMENT FEES

Early Bird Rate. P3,000 + VAT per participant

- For registration on or before Sept 20. Payment due on or before Oct 4.

Regular Rate. P4,000 + VAT per participant

- For registration and payment on or before Oct 10.

Group Rate. P3,500 + VAT per participant

- For 3 or more participants. For registration and payment on or before Oct 4.

Bring Your Big Boss Rate. P3,000 + VAT per participant

- Your Big Boss (President/SVP/VP or C-Level) is FREE, when accompanied by one or more paying participant

- For registration and payment on or before Oct 4.

For more information, please call (02) 543 2251 or e-mail This email address is being protected from spambots. You need JavaScript enabled to view it..